top of page

Search

Intergenerational Wealth: Teaching Kids to Preserve and Grow It

Creating wealth is only part of the journey— sustaining it across generations is the real legacy. History shows that wealth often disappears within two or three generations due to poor financial habits, lack of guidance, or insufficient planning. Teaching children not just to inherit wealth, but to understand, respect, and grow it , is one of the most powerful gifts a parent or grandparent can offer. 1. What Is Intergenerational Wealth? Intergenerational wealth refers to ass

Jul 12, 20253 min read

FIRE Variations: Lean FIRE, Fat FIRE, Coast FIRE—Which One Suits You?

The FIRE movement— Financial Independence, Retire Early —has gained momentum among people who want to break free from the 9-to-5 grind. But FIRE isn’t one-size-fits-all. Over the years, several versions have emerged to reflect different lifestyles, risk tolerances, and financial goals. The most popular? Lean FIRE , Fat FIRE , and Coast FIRE . This guide helps you understand each variation and choose one that aligns with your values and vision of freedom. What Is FIRE, Really

Jul 12, 20253 min read

Passive Income vs. Active Income: What’s the Difference and Why It Matters

For most people, earning money means going to work and receiving a paycheck. But there’s more than one way to build income—and understanding the difference between active and passive income is a game-changer on the path to financial independence. While active income relies on your time and effort, passive income can generate wealth even while you sleep. Let’s break down the two, compare them, and explore how to use both to build long-term financial freedom. 1. What Is Act

Jul 12, 20252 min read

How to Create a Legacy Fund for Future Generations

True financial independence isn’t just about securing your own future—it’s about empowering the generations that come after you. A legacy fund is a planned financial asset created to support your family, causes, or community even after you’re gone. Whether your goal is to leave behind wealth, values, or both, building a legacy fund is a powerful step toward creating a lasting impact. 1. What Is a Legacy Fund? A legacy fund is a structured pool of assets that continues to gr

Jul 12, 20253 min read

Investing in Gold: Physical, Digital, or Sovereign Bonds?

Gold has long been a symbol of wealth and a reliable hedge against inflation and market volatility. But today’s investor isn’t limited to buying jewellery or coins—there are smarter, more efficient ways to invest in gold, each with its own pros and cons. This guide compares physical gold , digital gold , and Sovereign Gold Bonds (SGBs) to help you decide which option fits your financial goals. 1. Physical Gold What It Is: Jewellery, coins, or bars purchased from jewellers or

Jul 11, 20252 min read

How to Read a Mutual Fund Fact Sheet Before Investing

A mutual fund fact sheet is like a health report card for a fund—concise, factual, and vital for informed investment decisions. Yet, many investors overlook it or feel overwhelmed by the jargon. Understanding how to interpret this one-pager can empower you to assess fund performance, risk, costs, and whether it aligns with your financial goals. 1. Fund Overview What to Look For: Fund Name & Category: Indicates if it’s an equity, debt, hybrid, or thematic fund. Fund House & F

Jul 11, 20252 min read

Demystifying ELSS, PPF, NPS: Which Tax-Saving Investment is Right for You?

Tax-saving is more than just reducing your liability—it’s also a gateway to long-term wealth creation. Three popular options in India are the Equity-Linked Savings Scheme (ELSS), Public Provident Fund (PPF), and National Pension System (NPS). Each caters to different investor profiles based on goals, risk appetite, and liquidity needs. Here's a breakdown to help you make the right choice. 1. ELSS (Equity-Linked Savings Scheme) What it is: A mutual fund that invests primarily

Jul 11, 20252 min read

Asset Allocation: The Foundation of a Balanced Portfolio

A well-diversified investment portfolio is not just about picking the right stocks or mutual funds—it's about structuring your assets in a way that balances risk and reward based on your financial goals, time horizon, and risk tolerance . That structure is called asset allocation , and it’s one of the most crucial decisions you can make as an investor. 1. What Is Asset Allocation? Asset allocation is the strategy of dividing your investment portfolio across different asset c

Jul 11, 20253 min read

How to Create a Will—and Why It’s Not Just for the Elderly

When people hear the word "will," many think of old age, estates, or something to worry about later in life. But in reality, creating a will is one of the most responsible financial decisions adults of all ages can make . Whether you’re in your 30s with young children or in your 50s nearing retirement, having a will ensures that your wishes are honored and your loved ones are protected. 1. What Is a Will? A will (or testament) is a legal document that outlines: Who inherits

Jul 10, 20253 min read

Navigating Finances After a Divorce or Separation: A Practical Guide

Divorce or separation can be emotionally and financially overwhelming. Amid the emotional shifts, you're also required to make critical financial decisions—many of which affect your stability for years to come. Here's how to take control of your finances and rebuild a secure future after a major relationship transition. 1. Assess Your New Financial Reality Start with a full assessment of your: Income sources : Salary, freelance, alimony, child support Expenses : Housing, chil

Jul 10, 20253 min read

How to Financially Prepare for a Career Break or Sabbatical

Taking a career break or sabbatical—whether for personal growth, family, health, travel, or study—is becoming increasingly common. But without careful financial planning, it can quickly turn into a stressful or debt-ridden experience. Here’s how to prepare your finances to make the most of your time away from work. 1. Get Clear on the ‘Why’ and the ‘How Long’ Before diving into numbers, define the purpose and expected duration of your break. Whether it's 3 months or 2 years,

Jul 10, 20253 min read

Retirement Planning in Your 30s and 40s: Why Starting Early Pays Off

Think retirement planning is something to worry about in your 50s? Think again. Starting in your 30s or 40s gives you a powerful advantage: time . And when it comes to money, time is what makes compound interest work its magic. Why Start Early? Every rupee you invest in your 30s or 40s has decades to grow . That means: Smaller monthly savings = Bigger returns You can take more calculated investment risks You avoid the stress of last-minute saving in your 50s or 60s Let’s look

Jul 10, 20252 min read

How to Plan Monthly Expenses When Your Income Is Irregular

Freelancers, gig workers, consultants, small business owners—more and more people today earn irregular income . While flexibility is great, the challenge is real: how do you plan your expenses when you don't know exactly how much you'll earn next month? This blog will walk you through practical steps to budget, save, and stay financially stable when your income is unpredictable. Why Irregular Income Is Tricky With a fixed salary, budgeting is straightforward. But when your i

Jul 10, 20253 min read

The Real Cost of Lifestyle Inflation—and How to Beat It

You get a raise. You celebrate. Soon, you're upgrading your phone, eating out more often, booking a better vacation. You're earning more—yet somehow, you're still living paycheck to paycheck. What happened? Welcome to lifestyle inflation. It’s a sneaky habit that quietly eats into your income, prevents long-term savings, and keeps you from reaching financial freedom. What Is Lifestyle Inflation? Lifestyle inflation (also called lifestyle creep) is when your expenses increase

Jul 10, 20252 min read

Cash vs. Card: Which One Helps You Spend More Wisely?

Swiping a card or handing over cash—does it really make a difference? Turns out, how you pay influences how much you spend , how well you track expenses , and whether you stick to your budget . The battle between cash and card isn't just about convenience—it's about psychology, awareness, and control. The Psychology of Spending When you use a credit or debit card, there's no physical loss of money. This "invisibility" makes it easier to overspend . A 2001 MIT study found t

Jul 10, 20252 min read

Sinking Funds: A Smart Way to Save for Irregular Expenses

We’ve all faced those surprise-but-not-really-surprise expenses—car insurance renewals, festival shopping, school fees, or home repairs. They don’t come every month, but when they do, they can wreck your budget. That’s where sinking funds come in: a strategic, low-stress way to handle predictable, irregular expenses without dipping into your emergency fund or taking on debt. What Is a Sinking Fund? A sinking fund is money you set aside regularly over time to cover a known

Jul 10, 20252 min read

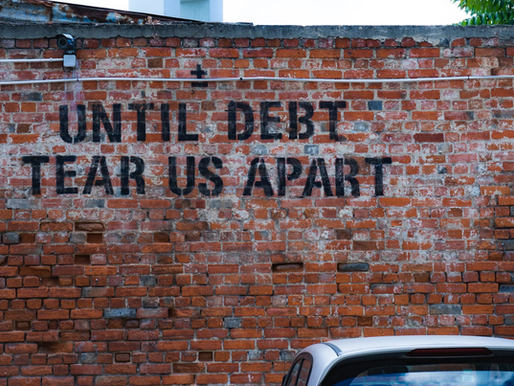

The Truth About Minimum Payments—and Why They Keep You in Debt

Paying the minimum amount due on your credit card every month might seem like a responsible move. After all, you’re not missing your payment—right? But here’s the hard truth: minimum payments are designed to keep you in debt for as long as possible . Let’s break down how it works, why it’s dangerous, and what you can do instead. What Is a Minimum Payment? The minimum payment is the smallest amount you must pay each month to keep your credit card account in good standing. In

Jul 9, 20252 min read

Debt Consolidation: When It Makes Sense (and When It Doesn’t)

Are you juggling multiple loans, credit card bills, and EMIs? Debt consolidation may seem like a smart way to simplify your finances—but it’s not a one-size-fits-all solution. Let’s break down when it works in your favor—and when it might cause more harm than good. What is Debt Consolidation? Debt consolidation is the process of combining multiple debts—like credit card balances, personal loans, or EMIs—into a single loan with one monthly payment. The goal is to: Lower your

Jul 9, 20253 min read

How to Choose the Right Credit Card for Your Lifestyle

Choosing a credit card can feel overwhelming with so many options available—but making the right choice can actually enhance your spending power, reward your habits, and help build a strong credit history . The key is to understand your needs, spending style, and financial goals before signing up for any card. 1. Understand Your Spending Habits Before applying for a credit card, ask yourself: Do I travel often? Do I spend more on groceries, fuel, dining, or shopping? Am I lo

Jul 9, 20252 min read

Secured vs. Unsecured Loans: What’s the Difference?

When you need to borrow money—whether it’s to buy a home, fund your education, or manage an emergency—understanding the type of loan you're taking is essential. Loans are broadly classified into secured and unsecured loans. Each has its own set of rules, risks, and benefits. Knowing the difference can help you choose the right loan based on your needs and financial situation. What is a Secured Loan? A secured loan is backed by collateral. This means you pledge an asset to

Jul 9, 20252 min read

bottom of page